|

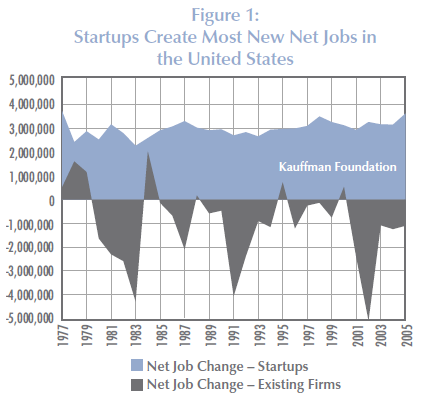

Startups Lost in the Mix In the world of government financial rescue, tax credits, subsidies, and guaranteed loans have been effective traditional interventions for stressed businesses in times of crisis. However, as these economy-boosting programs have targeted mature (large and small) businesses, they have not been accessible to startup companies. For startup companies, access to capital is not through banks or SBA programs, but through angel investor and venture capital investors. One of the main reasons for this is that most startups lack collateral, guarantees, and predicable revenue forecasts. Investors who invest in these types of companies are willing to accept these risks in order to participate in extraordinary returns. The benefit is not only to investors, however. Startups are a Pillar of the Economy These startup companies are a key foundation of the US economy. According to the Kauffman Foundation, when it comes to net job change in the US, startups create more net new jobs than mature businesses. In order to impact the complete business spectrum in time of crisis, any financial rescue plan for business should also target startup companies in that plan. A Solution to Get Financial Relief to Startups

To target startups that are affected by external crisis, such as the COVID-19 crisis, with government intervention, a schema cannot be transferred from a bank or SBA model. These models have their own regulations, risk parameters, and covenants that are not aligned to the startup world. The startup world must use facilities that are common to its own world. One such facility is the Convertible Debt Note. This is a loan to a startup company that has no personal guarantee or collateral. It is only “secured” by its right to be converted into a percentage of the startup company that receives the loan. For startup incubators and accelerators (especially publicly funded ones) that are familiar with these investment instruments, the repayment of debt or the return on investment from the converted equity can enable an evergreen or revolving fund. This is akin to the traditional revolving loan funds (RLF) for small business, but with startup criteria. In times of crisis, the startup community can be at larger risk than many mature companies. That is because startups run very lean and cannot rely on much reserve to carry them through a crisis. Often they are “pre-revenue”. Further, a startup’s only savior is from an investor. If venture funds are locked up, there are not many alternatives for a startup to stay alive and the already low success rate for this foundational component of the US economy becomes even lower. A Proposed Quasi Debt-Equity Relief Fund for Startups The creation of a Quasi Debt-Equity Relief Fund for Startups would target startups that are on a path for investment or sustainable revenue and have had that path interrupted by the COVID-19 crisis. The fund is intended to be a short-term bridge loan, but if it cannot be paid back in the short-term, debt could be converted into equity. If a 100-startup group is used as a model, it can be surmised that 25% or 25 startups may have the need and fit the criteria for such a program. With an average intervention investment of $100,000 per startup, a fund capitalized with $2.5M could help save 62.5 jobs (at 2.5 jobs per startup). More importantly though, one of those startups could be the next company to create thousands of jobs in the future and at the same time return monies to the now evergreen startup fund. Financial instruments like this exist at CenterState CEO’s Tech Garden in Syracuse, NY where over 100 startups are laying the foundation for new jobs. Join Our Advocacy Effort CenterState CEO’s Tech Garden wants to keep pushing this relief fund forward and will need startup and entrepreneurial support. We invite all of our peers, members and partners to share, like or comment on our social media channels, especially LinkedIn as we push our ecosystem requests forward. Thank you for your support. 3/25/2020 02:34:33 pm

We're highly reliant on government funding and contracting, through both the State and the federal governments. We've run into delays and postponements now (understandably). We have revenue, we have accounts receivable, but we don't have any cash coming in. 3/26/2020 04:43:25 am

We were in the middle of our first production run, taking the delivery of components on a daily basis and looking forward to the first fire-up of our Mãui 8500 Hybrid Power System and launching it at AUVSI Xponential 2020 In Boston in the first week of May. 3/26/2020 11:25:57 am

This is a excellent suggestion and approach to help sustain the start-up ecosystem through COVID-19; since absent something like this the failure rate of existing startups will sky-rocket within months. Since there is no way to earmark $ to individual startups, or reach them through e.g. banks or the SBA, it is the accelerator and incubator ecosystems and existing angel networks across the country that will have to step up and intermediate. A very worthy concept for inclusion in the 4th Stimulus; whose negotiations have already started in (virtual) DC. 4/17/2020 04:36:53 pm

Rick: I would like to set up a call to discuss potential advocacy efforts on this project 5/2/2020 02:49:38 am

Hey, Nice article! I liked your solution of getting financial relief for startups. Your concepts are very relevant. Thanks a lot for enlightening us about this. Comments are closed.

|

�

Archives

June 2024

|

|

The mission of CenterState CEO’s The Tech Garden is to stimulate high-tech entrepreneurship, foster the development of emerging growth companies, and support technology commercialization throughout the region.

|

© COPYRIGHT 2023. ALL RIGHTS RESERVED.